Enterprises across all industries have a tech-centric tendency to characterize their evolving cloud strategies as transformation initiatives unto themselves. This tendency is both inaccurate and somewhat comical—it ignores the reality that all cloud transformation efforts are the modernization of infrastructure, data, and applications.

In banking and financial services (BFS), where any firm over 20 years old has a collection of legacy core banking systems and proprietary or heavily customized applications, mainframes, and data centers, the palpable need to modernize these core innards drives the journey to the cloud in its myriad permutations. HFS explored the relationship between modernization initiatives and cloud transformation to better understand the underlying drivers and desired outcomes. HFS interviewed leaders from two financial services firms in the midst of modernization initiatives. These firms are using Capgemini as their strategic service partner and leveraging AWS as their hyperscaler partner for the initiatives discussed. While one focuses on cloud foundations and regional readiness and the other on mainframe modernization, both exemplify evolving cloud strategies with distinct tech challenges and desired business benefits.

In a recent HFS study, we surveyed 508 IT and business leaders about their current approach and plans for cloud-native transformation. Of the 75 financial services leaders surveyed, 69% indicated their cloud strategy priority is technology transformation rather than business or functional transformation. This differs from other industries that portray a more balanced approach with business and functional transformation at a slight majority (53%). This tech-forward finding was echoed in a recent study from Capgemini’s Research Institute for Financial Services World Cloud Report, where 89% of financial services firms consider having the right platform as essential to achieving business goals.

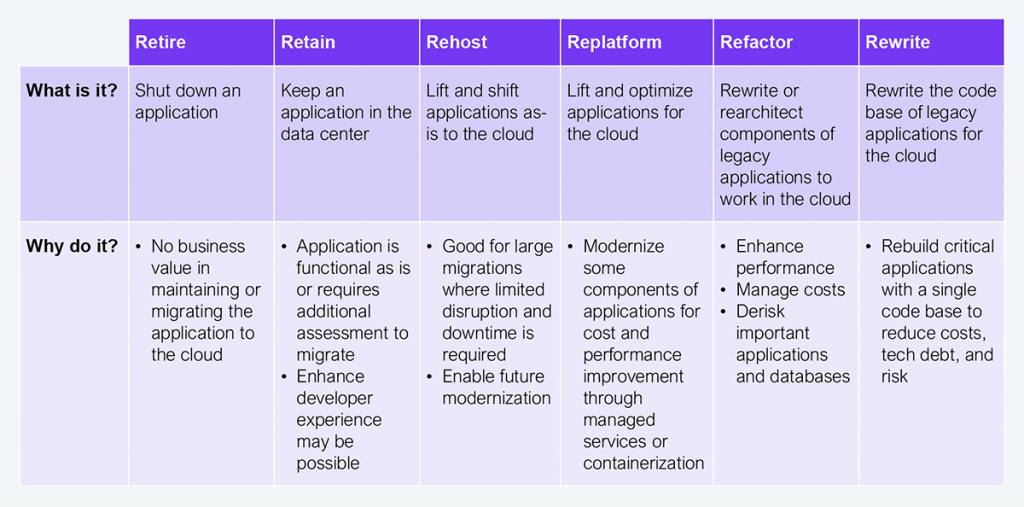

HFS’ read of this data points to legacy tech as the culprit. Whether a project involves modernizing in a delicate rehost, replatform, refactor, or rewrite dance or orchestrating a mainframe exit, it’s a massive technology transformation. For many financial services firms, the heart of their cloud strategy is their approach to mainframe modernization and related infrastructure, data, and application change. While technology change may be the underlying driver, the outcomes need to be an intentional balance of tech and business benefits.

Other industries include manufacturing, high-tech, consumer goods, retail, healthcare, life sciences, and insurance

Sample: 75 BFS executives and 433 executives from other industries across Global 2000 enterprises

Source: HFS Research, 2024

A global credit reporting agency has been on a multi-year cloud migration journey intended to help it reinvent and modernize its product delivery platform, drive cost savings and efficiency, and increase the pace of innovation, all using public cloud. The firm’s cloud journey started with the design and build-out of its foundational cloud platform—the infrastructure and security capabilities that would let it securely move, build, and run applications on its cloud platform.

According to the credit reporting agency’s Vice President of Global Cloud Transformation, the definition and build-out of this foundational capability unlocked and enabled efficient migration paths. It was essentially a tech-transformation approach necessary to enable downstream business transformation.

The credit reporting agency initiated the build-out of its foundational cloud platform in the US, where it is headquartered, to define a strong baseline. The US served as the anchor region, where various standards were defined with the intent to be replicated with appropriate regulatory and data sovereignty approaches for other regions. It selected AWS as its hyperscaler partner of choice. Its US build-out included several key tenets:

The US build-out commenced in 2020 and went live in 2022. The credit reporting agency’s Vice President of Global Cloud Transformation, a cloud migration veteran with a decade of experience and four cloud transformations under his belt, emphasized, “We took the time to build the platform right, yielding us a template for other regions and significant competitive advantage.”

Capgemini helped drive regional cloud readiness

Once the global credit reporting agency had its cloud foundation defined and implemented in the US, it was ready to replicate its “build once, deploy many” approach in other geographies, executing with velocity. It prioritized the UK, where it had a clear business case tied to moving critical applications to the cloud and shutting down a data center once complete.

The firm tapped Capgemini as its partner to execute the UK build-out. The credit reporting agency needed Capgemini’s help because while it had great cloud engineering talent in-house, they were largely deployed on the US cloud environment to drive and maintain application migrations and platform enhancements for security uplifts. Capgemini was an existing partner of the credit reporting agency with a 10-year-plus relationship. The credit reporting agency’s Vice President of Global Cloud Transformation indicated why it selected Capgemini:

We had deep experience working with Capgemini. We could have found a dozen partners to do it, but we wanted three things at once: one, talent at scale; two, a partner who knew our environment; and three, someone we trusted. Capgemini brought all three.

—Vice President of Global Cloud Transformation, Global credit reporting agency

Capgemini, working with AWS, helped the credit reporting agency set up its regional cloud posture in the UK. It leveraged the US designs, validating and adjusting for the UK environment. Regional readiness was essential to ensure compliance with local data protection and privacy requirements, such as the UK’s GDPR (General Data Protection Regulation).

A strong cloud foundation is essential for successful data and application migration

The successfully implemented UK cloud environment helped the credit reporting agency make significant progress with its migration expansion and platform naturalization, yielding significant cost and efficiency impact. With the cloud foundation in place, the emphasis turned to refactoring and rewriting applications to unlock business value. The credit reporting agency plans to take some ancillary corporate systems and shared services to SaaS, but the main event is tied to transitioning its core online credit systems and apps underpinning other offerings and core capabilities. These systems are tied to about 40% of the firm’s revenue. As HFS has written extensively, effective cloud transformation is always rooted in a strong alignment between technology and business objectives.

Modernization needs and objectives are particular to each financial services enterprise. The global credit reporting agency prioritized establishing a strong cloud foundation and then drove various re-platforming, refactoring, and rewriting initiatives to move its legacy data and applications into the public cloud. While legacy comes in many forms, in financial services, mainframes are still in heavy rotation with various associated challenges.

These challenges include the rising cost of MIPS (millions of instructions per second), escalating costs associated with maintaining data centers, declining skills for maintaining legacy code, monolith applications that impede efforts to launch new products and services, and challenging test and development environments—all loosely rolling up to the problem statement “our business needs are not being met.” While the solution is generally and increasingly cloud migration, various approaches to mainframe modernization align with the problems financial services firms are trying to solve and the desired outcomes. Exhibit 2 summarizes six approaches to application migration to the cloud based on business needs.

Source: HFS Research, Capgemini, and AWS, 2024

For the past 10 years, an American investment management company has driven mainframe modernization across its multi-faceted business to reduce costs, mitigate risk around aging technology and code, ensure security and regulatory compliance, accelerate innovation, and improve customer experience. Throughout the effort, it has employed all the approaches Exhibit 2 outlines based on business needs related to different operating units.

During the past three years, it prioritized modernizing its customer statements and confirmations communications, a massive mainframe-based batch processing operation of millions of monthly and quarterly communications. Statements and confirmation are required by regulators; statements must go out quarterly if no new activity is reported and monthly when account activity is noted. Confirmations are event-based, such as trade confirmations and address changes. These statements and confirmations require a heavy-duty data operation. When the investment management company wanted to build corresponding applications for its website, it needed help undertaking a massive application rewrite effort.

Capgemini rewrote mainframe apps to reinvent customer communications for an investment management company

The investment management company wanted to modernize four applications tied to statements and confirmations for its investment management clients. It did not want to retire or replatform the core mainframe-based application running these processes. Rather, as articulated by the Application Engineering Lead overseeing statements and confirmations, it wanted to “chip them out of the monolith mainframe application using microservices and bring them to the cloud.” The firm tapped Capgemini as an existing, trusted partner to help bring the modernization initiative to life. According to the Application Engineering Lead, a 25-year veteran of the investment management firm,

We did not want to move the monolith application. We couldn’t. We orchestrated this as a lift and shift from a capabilities and functionality standpoint. But make no mistake—this was a full rewrite. Capgemini had to understand the current logic and build it in a new language with a new UI in the cloud. Capgemini did it all, soup to nuts, creating modernized apps—really the whole external website.

—Application Engineering Lead, Customer Communications for an American investment management company

The engagement was based on key milestones and deliverables, with the Capgemini team comprising 20% onshore and 80% offshore. The onshore team was initially the main SCRUM, UI, and Java tech leads, with the balance offshore. Capgemini leveraged agile methodologies, prioritizing one app at a time and working through the analysis, storyboard, API, modernization, test, perpetual maintenance, update, and roll-out phases. Then, it rinsed, repeated, and moved on to the next app, cycling through the four in-scope applications. Capgemini reverse-engineered Java and mainframe code to identify data dependencies, leveraging its CAP360 assessment framework to bring the initiative to life.

The communication modernization initiative enabled availability, flexibility, and compliance

The investment management company indicated the key outcomes realized include three key areas:

This modernization initiative represents technology transformation, but it clearly shares the spotlight with business benefits.

In financial services, modernization initiatives are the key drivers in the journey to the cloud. Addressing legacy challenges presents as a technology transformation opportunity, but the journey to the cloud must balance technology and business needs and yield benefits for both. As evidenced by the modernization journeys of the global credit reporting agency and the American investment management company interviewed for this research, technology transformation goes hand in hand with business transformation. Financial services enterprises need to ensure their approach to modernization sufficiently balances these elements and treats cloud migration as an opportunity to beat down tech debt while driving new business models of the future.

On the journey, trusted partners such as Capgemini and AWS can deliver essential build-and-run capabilities to help financial services enterprises bring their visions to life. As both companies interviewed for this research articulated, a partner with tech skills like cloud engineering capabilities is useful. A partner that brings tech skills and demonstrates industry-specific and business-specific knowledge is invaluable. Capgemini’s relationship with AWS combines capabilities in an effective ecosystem. Ian Campos, Global Head Application Services, Capgemini Financial Services, summarized the synergies that result from integrating strong partners and critical capabilities:

You need to be ‘3D in C’—domain, digital, and data in the cloud—to become the partner of choice, and Capgemini Financial Services is that to AWS.

—Ian Campos, Global Head Application Services, Capgemini Financial Services

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started