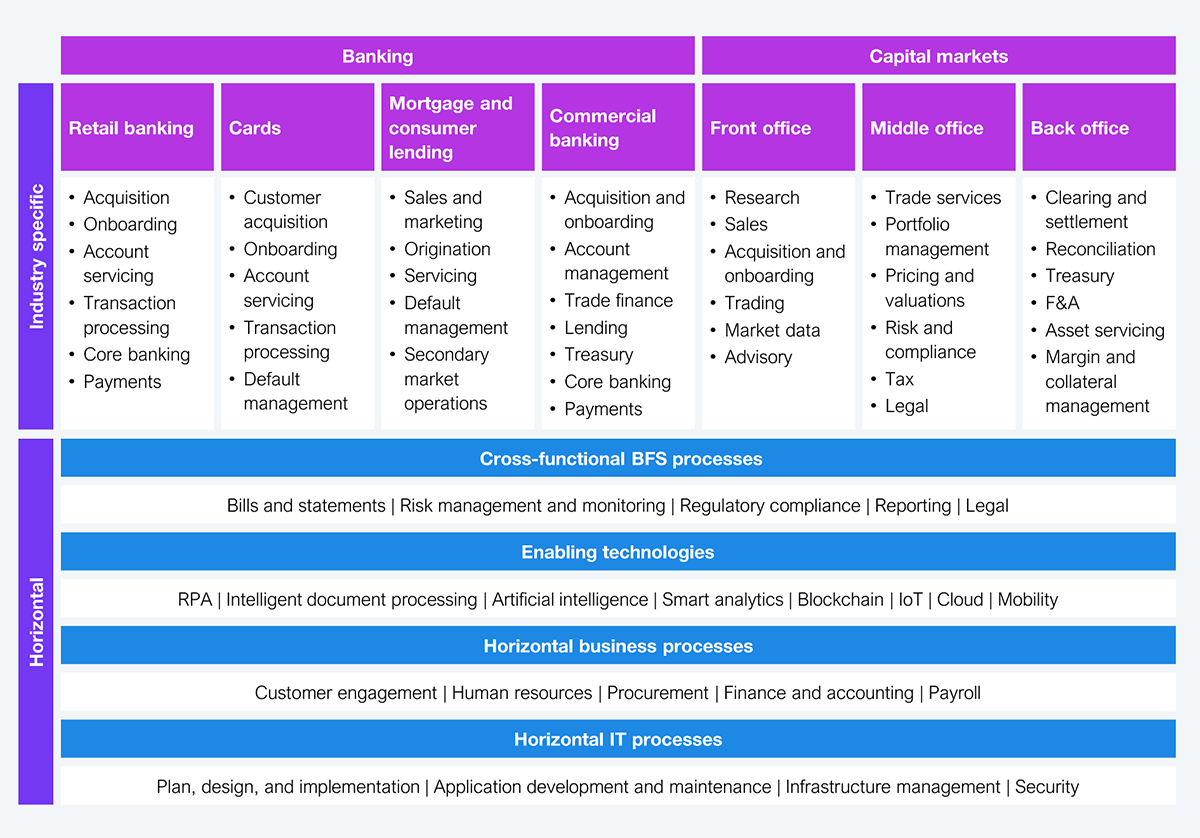

Historically, banks have owned the end-to-end value chain, as shown in Exhibit 1, monetizing customer relationships through interest and fees. But today, with the advent of open banking, they are victims of their success as new actors chip away at the banking value chain.

So, what is open banking? Open banking is not one discrete product or service but a framework that leverages application programming interfaces (API) to securely share bank customers’ data (with their consent) with trusted third-party providers (TPP) to enable growth for all participants. The hope is these TPPs will use this data to develop innovative financial products and services, driving greater competition and innovation within a dynamic data-sharing ecosystem.

Banks have long relied on a captive audience, with customers accepting what’s offered. However, times are changing, and banks must recalibrate their strategies to maintain market dominance in the evolving era of open banking.

Note: Banking—Retail banking, mortgage and consumer lending, commercial banking, and card services; Capital markets—Investment banking, brokerage services, asset management, wealth management, and global markets. We have depicted the process across these in terms of front, middle, and back office processes.

Open banking is not as straightforward as our capsule description suggests. While APIs have been integral to banking for years, they are now taking center stage for transforming financial service delivery.

A simplified view of open banking propositions breaks into two main categories:

Open banking is an intended equalizer, with payments emerging as the poster child of the framework’s success. Payments showcase a rapid innovation cycle, with new products and services constantly conceived and proven revenue pools tied to accrued business value from active customer transactions. Beyond payments, open banking enabled account aggregation, expenditure analytics, and financial product comparison activities. These aren’t new concepts; the only change is how information is delivered. Therefore, we hesitate to label open banking as disruptive—a term often overused for industries needing a shakeup. When the top five most transformative trends in banking are teased out from 450 bankers, as shown in Exhibit 2, two are directly enabled by the open banking framework, showcasing its potential.

Sample: 450 BFS leaders across the Global 2000

Source: HFS Research, 2024

Open banking is a win for both consumers and TPPs. It empowers customers with ownership and control over their data, allowing them to share it with institutions of their choice. In return, they gain access to a broader range of financial services from a growing ecosystem of TPPs, creating new opportunities for these providers. While large BFS firms hold the home court advantage of consumer trust, they often struggle to articulate value and secure internal support for open-banking initiatives that primarily benefit consumers and TPPs. As open banking reshapes the competitive landscape, customers are prompted to reevaluate their traditional banking relationships, giving competitors a chance to lure them—and their profit pools along the way. While banks see customer loyalty as a key attribute to their success, as seen in Exhibit 3, retaining customer loyalty in this decentralized ecosystem has become a critical challenge for banks.

Sample: 450 BFS leaders across the Global 2000

Source: HFS Research, 2024

Sharing data might be a big leap for some banks, but open banking offers the same opportunities banks have always pursued: accelerated growth, competitive differentiation, enhanced customer experiences, and new revenue streams. To put their data where their mouth is, banks must build a robust tech stack with three critical elements: API-first design, microservices, and real-time capabilities.

Banks should prioritize APIs that deliver a superior customer experience and assess the technology stack for lower costs to serve customers through APIs and seamless integration. They also should adopt a microservices-based architecture to overcome the challenges of legacy systems. Also, integrate APIs to draw data from the core and customer channels. They offer a higher monetizable advantage as they can create an event stream that gives third parties access to a wealth of data updated in real time.

While some banks may be eager to embrace open banking, it’s not as simple as opening the data floodgates. Poorly implemented APIs can lead to tangled integrations and security gaps. Banks must invest thoughtfully in data sharing and security to mitigate risks and build trust. High-profile bank data breaches, including First American Financial Corp, Equifax, Capital One, JPMorgan Chase, and Experian, highlight the industry’s exposure. While not all the breaches stemmed from API vulnerabilities, APIs escalate the threat. Avoid uncontrolled data sharing, especially with workarounds such as screen scraping. When establishing guardrails around the data, ensure you understand who shares it, why it’s being shared, and how third parties use it. Lastly, ensure scalability, stability, and consistent performance by focusing on seamless API management.

Beyond the well-known Payment Services Directive (PSD2; requires banks to open their data to third parties) and the UK’s Open Banking Standard (requires the largest banks in the UK to do it in a standard way), which pioneered the open-banking framework, numerous initiatives are emerging with varying characteristics and use cases, as shown in Exhibit 4. These varying jurisdictions include differences in the types of information accessible to TTPs and the entities, products, and financial operations included within their scope. Inconsistencies across frameworks are creating growing pains. In regions without formal or mandatory regulations, policymakers are pushing forward with makeshift measures to promote and accelerate data sharing—often putting sensitive customer financial data at risk.

Source: HFS Research, 2024

Open banking aims to foster healthy competition and innovation. However, it puts banks at a disadvantage, as they have many hard yards to cover before they can monetize it effectively.

Meanwhile, unburdened by legacy systems, nonfinancial incumbents are eager to take the lead with their nimble digital readiness. To stay ahead, banks must overcome inertia, apart from focusing on the three critical elements outlined in this report to enable the infrastructure for open banking. They must also leverage their sizeable customer bases, capitalize early on deep customer insights as a competitive edge, and curate partnerships with TTPs that augment the best attributes of banks and TTPs to accelerate growth.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started