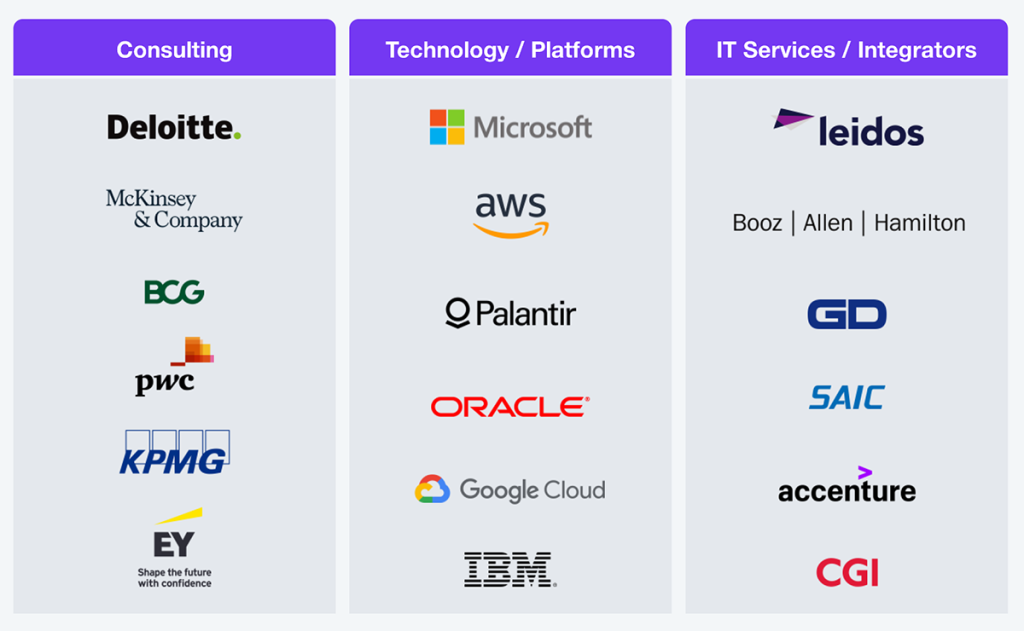

The public sector globally has hollowed out its in-house expertise and capacity. It has landed with consulting and other outsourcing firms—from strategy and management to IT and service delivery (see Exhibit 1). The current public sector efficiency drive, loudest in the US but ongoing worldwide, is a massive opportunity to reevaluate and renegotiate these outsourcing contracts. All public sector outsourcing, whether advisory, delivery, or technology, must be framed by value and outcomes to what matters most—people.

Services firms must still play a vital role in the public sector. They can bring resources, expertise, and experience. But, the public sector service provider relationship must be reframed and rebuilt to find a new level of two-way partnership based on trust, transparency, and mutual upskilling so no one side of the relationship is dependent on the other systemically, to the detriment of people and society.

The public sector must ensure that its definitions of fat and muscle are exceptionally clear in its trimming efforts. Governments at all levels have statutory responsibilities, such as social security or major healthcare programs which cannot be legally jeopardized. But neither should discretionary spending that supports equally critical outcomes, including education, housing, public health, transportation, or addressing the climate and sustainability emergency.

FY 2025 will see mandatory US spending reach $4.13 trillion with discretionary spending at $1.82 trillion. Although discretionary spending is substantially lower than mandatory spending, that doesn’t mean it is not underpinning essential public services. Reframing outsourcing to laser-focus on value, outcomes, and outsourcing relationships is vital.

Source: USAspending.gov, Bloomberg Government BGOV200, HFS Research, 2025

In FY 2023, the US federal government obligated over $759 billion to contracts, setting a record high. Nearly half of this went to professional services, R&D, and tech support, with giants such as Accenture, Deloitte, IBM, and Booz Allen. This spending is now facing increased scrutiny. Agencies have been told to justify consulting contracts in plain English. ‘The contracted’ must now demonstrate what was delivered, what value was created, what systems changed, and what waste was reduced. It’s a reckoning that, in its best possible version, will move public sector consulting engagements from opaque transactions to outcome-driven partnerships.

Across the OECD group of mostly-rich countries, one in four central government workers was aged 55 or older as of 2020. To reduce dependency on outsourcing, governments try to rebuild internal capability where it can be done efficiently and achieve the right outcomes. Public sector consulting and other outsourcing contracts should prioritize knowledge transfer, upskilling, and clear exit strategies. Otherwise, current cost-cutting measures will deepen tomorrow’s reliance, just possibly in a different form.

Public sector budget cuts aren’t just theoretical. In 2024, the US Department of Veterans Affairs alone canceled or renegotiated contracts worth more than $1.8 billion in contracts. Broader executive orders aim to reduce federal spending by as much as $2 trillion over the next decade. As we’ve seen, this is more than the whole discretionary spending available in the US government. However, discretionary budgets are facing the sharpest reductions, even though many outcomes—from education to disease prevention—are delivered from that very pot.

Yet not all cuts are equal. Services firms that offer automation, AI, and SaaS solutions are increasingly seen as part of the solution. If they align their pricing with the impact of their services, that effect could multiply. Palantir grew its federal revenue by 45% year-over-year in Q4 2024. This indicates that given the incentive, the government is willing to spend—whether you agree with that spending is another matter.

Consultants and other services firms that embrace this trend can remain relevant, but they must invest in flexible commercial models, technology-driven process efficiency, and fast implementations.

Public sentiment is hardening. In both the US and UK, centralized procurement systems and caps on consultancy spend are gaining traction. For instance, the UK has slashed planned consultancy budgets by more than 70% between 2022 and 2024 as part of broader civil service reforms. Yet even with tighter controls, top firms still secured more than £800 million in public sector contracts in just six months of 2024.

The public sector doesn’t need to eliminate outsourcing, but rather ensure it delivers clear, people-first outcomes. This means implementing scalable digital tools, actionable insight from data, and public sector teams equipped to challenge and co-create with providers.

Procurement language must evolve to define value in human terms.

The next era of public sector outsourcing must be built on delivery clarity, human-centered value, and mutual accountability. Governments should not aim to be self-sufficient in everything—that would be inefficient and unaffordable, especially in the short to medium term. But they must become experts at being clients.

If service providers want to remain relevant in this shift, they must be partners in capability-building, not be gatekeepers. The future isn’t fewer contracts—it’s better ones. Ones that serve people, not processes.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started