After nearly two years of tinkering in the garage, software products have finally included embedded agentic and GenAI capabilities into their core architectures. Notable arrivals to the market include ServiceNow and Salesforce, but many other software companies are rushing GenAI and agentic updates before clients replace their products with DIY solutions.

We recently laid out a vision of three models, but a fourth, potentially more compelling model, the ‘orchestrator,’ is evolving quickly. Both enterprises and software companies are building intelligent workflows at scale using unified platforms such as ServiceNow, and it is reshaping the operating models and causing some software companies to ditch DIY solutions in favor of a partner ecosystem approach.

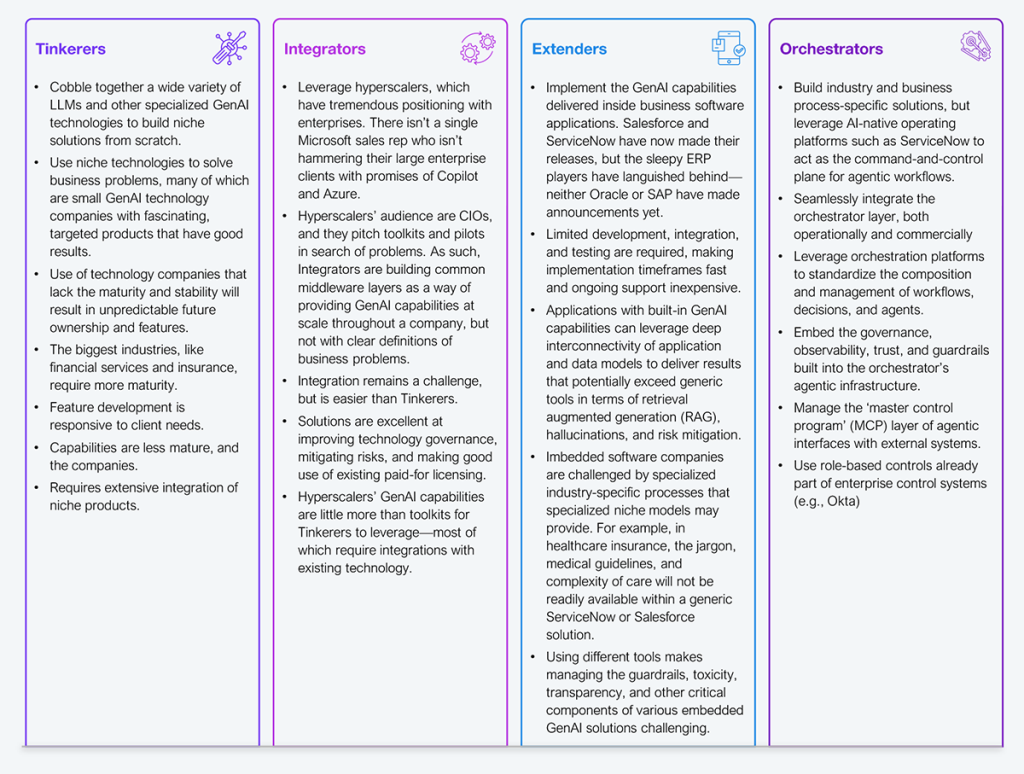

Enterprise personas can now be defined in four models, including the new fourth orchestrator model (see Exhibit 1).

Source: HFS Research, 2025

At this point in early 2025, tinkerers are stuck in proof-of-concept purgatory rife with redundancy and speed-to-market challenges. Integrators have limited competitive differentiation and, currently, fragile agentic capabilities, and extenders are adopting software products with new agentic capabilities that increase lock-in and limit scalability. All three lack a cohesive coordination system across processes, data, and intelligent agents. Orchestrators are leveraging the robust capabilities of products such as ServiceNow to provide centralized control, faster ROI, and strategic agility.

ServiceNow is evolving from IT workflow automation to business agent orchestration. Most organizations already have investments in ServiceNow, but the firm has struggled to take on business process workflows due to the application’s limited industry and operational capability. Now, the company is leveraging its current IT operations-centric foothold to expand and make large-scale investments in agentic capabilities to serve software companies that cannot match its level of investment.

Further, client pushback is minimal because clients have already made the ServiceNow investment in IT—CIOs will feel vindicated in their investment now that their business leaders can leverage the same secure backbone. In conjunction with technology providers, ServiceNow enables enterprises to coordinate autonomous agents, not just automate tasks. That said, ServiceNow remains an IT-centric platform that lacks industry process management and is rarely used in business process areas due to customization requirements. This is why it’s a better orchestrator than it would be a core product.

DXC’s Assure BPM (business process management) product is a superb example of a grizzled industry veteran, with nearly 25% of the world’s insurance premiums running through its systems. By partnering with ServiceNow, DXC provides powerful agentic BPM capabilities to its clients. Targeted use of agents in domain-heavy insurance workflows provides DXC’s current and potential clients with a powerful industry-specific solution as an incremental upgrade rather than a costly complete system replacement.

The underlying AWS infrastructure provides scalable modernization, data readiness, and service extensibility that clients would otherwise consider potential risks if left under more proprietary infrastructure management solutions. Insurers are the winners here, as they get a lower-risk modernization path and the ability to launch new products leveraging existing agentic process solutions rapidly. Other industries with legacy process platforms, such as retail core systems, financial operations, clinical management, or logistics platforms, should view this ecosystem partnership as a blueprint: you can leverage the heavy investments made by major agentic solutions and provide clients with an inexpensive upgrade path.

While pairing these three firms is not a revolution, it strongly signals that large IT services players see the platform orchestration layer as strategic IP. The orchestrator model will attract major technology providers, but few have the credibility to serve as a neutral, cross-functional, fully capable agentic orchestration layer.

SAP and Oracle will need to escape their suite silos that lack consistent infrastructure, while AWS and Microsoft compete with various ecosystem ‘partners’ they resell to provide a consistent solution. Customers of Salesforce will have to wait and see if it can abstract its Agentforce from its sales, service, marketing, and commerce ‘clouds’ to partner with industry-specific solutions as an invisible backend. These aren’t the only areas to focus on: there is strong agentic demand in many areas, such as retail, financial services, supply chain, financial operations, procurement, manufacturing, and other industries and functions. Clients need to find orchestrators that provide them with the following:

The platform era of agentic AI is here, and there are likely to be more entrants, such as Microsoft, AWS, SAP, and Oracle. Enterprises that keep tinkering with niche solutions will fall behind. Market leaders will win by allowing technology companies to orchestrate their ecosystem, not stitch together point solutions, each requiring substantial governance and management. Despite the risk of lock-in, choosing an orchestration partner wisely will serve as rocket fuel to launch all your agentic opportunities.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started