The emerging shift towards Services-as-Software is grounded in enterprises buying services that incorporate elements of AI to deliver the work of humans. Hence, services are becoming less expensive to deliver, and enterprise buyers should expect to pay for either successful business outcomes achieved from the services or a pay-per-use model that most software firms deploy today. However, this requires a fundamental mindset shift from both buyers and suppliers who have been pricing services the same old way for decades.

This increasing use of AI across services, the frustration with inconsistent pricing models, and the need to preserve trust with enterprise buyers who don’t understand the black box of AI are forcing a pivotal reevaluation of how professional services should be priced.

Professional services and outsourcing buyers have long been assumed to act rationally, systematically analyzing costs and benefits to make optimal pricing decisions. Yet, behavioral economics reveals a critical insight: buyers are far from rational, which explains why they built the full-time equivalent (FTE) pricing model that has become predominant today. Psychological biases significantly influence pricing perceptions and decisions, which have become even more pronounced with the rise of AI-driven service models.

In this three-part series, we examine enterprises’ frustration with the so-called ‘outcome-based’ pricing with which service providers are obsessed and provide practical pricing advice to both sides.

Companies have difficulty shifting from decades of FTE-based pricing, a pattern explained by anchoring bias. This cognitive effect, first identified by Tversky and Kahneman, occurs when initial reference points disproportionately affect decision-making. In this context, clients firmly anchor to their previous decades of cost benchmarks, whether FTE, hourly rates, or fixed project fees. After years of negotiation and contracting, enterprise buyers know all the ins and outs of this form of pricing, leaving little interest in exploring other options.

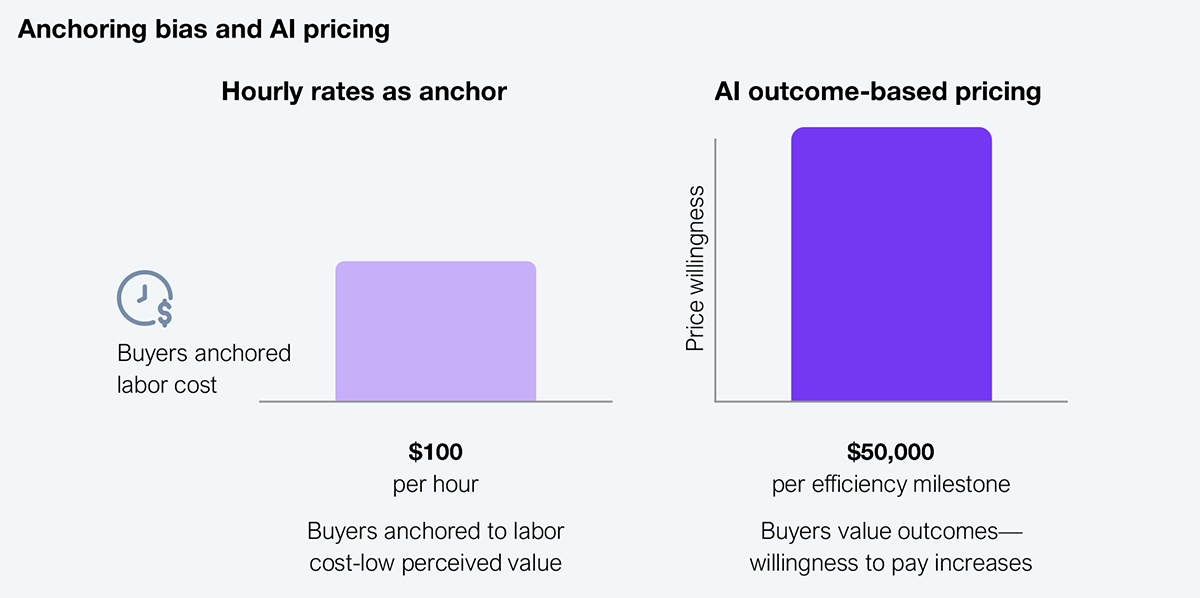

As AI introduces radically different efficiency levels and potential pricing structures, this inflexibility becomes a problem, and firms must proactively set new value anchors. For instance, an AI-powered legal advisory platform at a law firm can dramatically reduce the hours required for lawyers to conduct contract reviews. If the firm presented pricing anchored purely on the traditional hourly rate, this change would severely slash pricing and significantly undercut the perceived value delivered (see Exhibit 1).

In short, when a customer engages with a law firm, all they care about is achieving their desired legal outcome as quickly as possible. Hence, the whole rationale of billing by the hour hurts both—the law firm and the law firm’s customers.

Look at McKinsey’s eyewatering rates, and you’ll understand that many boardrooms believe good things don’t come cheap. Law firm rates are no different.

Source: HFS Research, 2025

To avoid anchoring bias, leading providers should refrain from presenting options or transparency that allow clients to compare FTE pricing with outcome-based pricing. Rather, right out of the gate, providers should anchor on outcome-based metrics, such as ‘risk reduction’ or ‘contracts successfully reviewed per week,’ shifting the reference from FTEs to outcomes. Note the term ‘successfully,’ which helps with fairness (our next topic).

On the other side, enterprise buyers should seek to understand their true total cost of ownership (TCO) and ask for pricing that emphasizes efficiency, quality, and reduced risk implied by the use of AI, not consumption alone.

Anchoring isn’t the only mental trap in play. Perceived fairness, a concept rooted in behavioral economics research by Kahneman, Knetsch, and Thaler, heavily influences pricing acceptance. Remember 2020’s toilet paper phenomenon or the 2025 egg price spikes? Has a software company ever proposed a renewal with a 15% price increase? Behavioral economics illustrates—as Kahneman, Knetsch, and Thaler found—that clients resist and reject pricing and price increases that are seen as exploiting situational demand spikes.

On the other hand, clients will accept higher prices transparently tied to increased costs or demonstrable value. Services companies’ use of AI is widely considered valuable to buyers because it should reduce billable hours, and buyers expect lower fees. With AI automation driving service efficiencies, consulting and outsourcing firms face a fairness dilemma: Should savings from automation pass entirely to clients or be shared?

Solving this problem requires a narrow focus on the increased value that impacts buyers. Providers that transparently frame their AI-driven savings, positioning pricing as ‘shared value’ rather than opportunistic profit-taking, will find far greater client acceptance and deeper trust. This should be coupled with transparency on quality and risk improvements. This combined, open approach is a strong early-stage solution that we believe will succeed until a steady history and performance standards evolve over the coming year or two. At that point, with anchors deeply established, providers can move to an entirely outcome-based approach and simplify their pricing proposals. That said, providers who demand substantially higher profitability than they are due are not being fair—buyers will sniff you out like a preschool teacher trying to find a child with a dirty diaper.

On the buyer side, it is high time that enterprises acknowledge the value they receive from the investments made by the providers. There is a symbiosis between buyers requiring services and service providers improving the quality of those services, but only to a point. Providers must be fair in pricing those services because they, ultimately, are not underwriting the buyers’ risks.

Beyond anchors and fairness, not all expenditures are equal in buyers’ minds. Capex dollars, project budgets, and software purchases are always more gated and scrutinized than operating expenses, department budgets, and service purchases. This phenomenon, known as mental accounting and introduced by Richard Thaler, explains why buyers treat different expenditures with distinct psychological significance.

AI-driven service models also directly influence how clients psychologically process costs because they access different types of spending. One great example is how hourly or transactional pricing tightly couples cost with consumption. Transactional dollars are viewed as more valuable because of potentially high invoices as the hourly meters keep ticking after hours and over the weekends, a reaction described by Prelec and Loewenstein as the ‘taximeter effect,’ where costs tightly coupled to usage trigger greater psychological discomfort (see Exhibit 2). To reduce this ‘pain,’ service providers cap or fix fees.

Source: HFS Research, 2025

AI-enabled automation exacerbates this effect as hourly charges feel increasingly unjustified when tasks appear automated (remember, the anchors remain: buyers have a strong memory of people-based processing at this point). As a result, fixed or subscription-based pricing, which decouples cost and consumption, is the best solution. Enterprises will psychologically perceive this as ‘pain-free’ spending, making it predictable, justified, and aligned with the value delivered. It boosts acceptance and satisfaction and reduces the occurrences of a red-faced procurement manager berating the team’s ‘ludicrous transaction pricing.’

Services companies should learn from software companies: this is why SaaS expanded so quickly. Remember, friction slows deals, and low-friction pricing gets deals done quickly and easily, leaving an impression that your firm is easy to do business with—a highly valued attribute of services buyers.

Finally, loss aversion—a core idea from Kahneman and Tversky’s prospect theory—shows that avoiding losses motivates behavior more powerfully than pursuing equivalent gains. This concept is especially relevant amid AI transformation. Enterprises fear losses from unproven technologies or unanticipated AI outcomes—an issue illustrated in 2024, the year marked by the failure of 1,000 pilots. These losses affect their companies’ bottom lines, but we believe the bigger issues are embarrassment and potentially ending an executive’s career.

B2B buyers are far more emotionally tied to their decisions than retail consumers because of the decisions’ impact on their careers. Hence, pricing structured explicitly to mitigate perceived losses, such as ‘performance guarantees’ or ‘no-success-no-fee’ arrangements, becomes compelling. For example, AI-based predictive analytics services structured around explicit outcome guarantees (‘less than 98% quality, you don’t pay anything’) dramatically reduce perceived client risk, enhancing willingness to adopt innovative solutions (see Exhibit 3). Of course, providers’ CFOs have their risks to consider when applying these approaches. So, the best solution is a ‘minimum fee + performance guarantee’ hybrid.

Source: HFS Research, 2025

In professional services and outsourcing, the integration of AI fundamentally alters the pricing landscape, which has long been rooted in time-based fee structures. Providers must abandon purely rational pricing assumptions and strategically leverage behavioral insights, anchoring on outcomes rather than effort, transparently addressing fairness, decoupling payment from incremental usage, and carefully mitigating loss aversion.

Buyers need to start accepting that the world is shifting to a new delivery model powered by technology. Therefore, the pricing models from software need more acceptance, including the opaqueness of the underlying fees, because the TCO of the fixed-price deal should make sense. Those who master these psychological dimensions will capture AI’s full value, forging stronger client relationships and sustaining competitive advantage.

Up next in this three-part series: The psychology behind why enterprise buyers pay more—and love it

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started