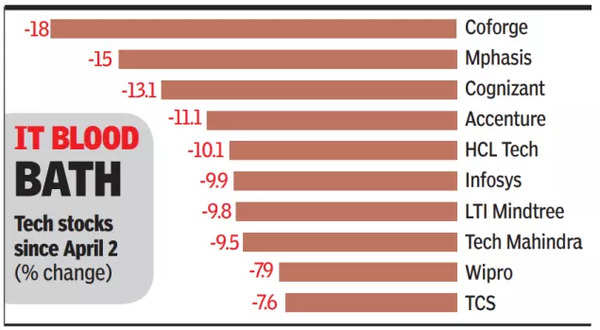

BENGALURU: Doing more for less is regaining traction in the IT sector. Indian IT firms are grappling with volatility and bearish sentiment amidst a widespread stock market rout. Infosys and HCLTech stock prices declined by nearly 4% on Monday, while Cognizant and Accenture dropped 4% and 2% respectively in early trade on Nasdaq. US remains the largest revenue-contributing geography for large IT firms, accounting for over 50% of industry revenue. The IT index declined approximately 20% year-to-date, indicating elevated uncertainty stemming from Trump’s reciprocal tariffs. IT companies were hopeful of some recovery in discretionary spending, but the current scenario will further push the recovery cycle.

Incred Equities, in its research note, said the recent uncertainty and lack of urgency to spend could potentially moderate spending pattern and, in turn, heighten call for ‘doing more for less’.

“This implies vendors need to optimise existing projects to fund discretionary/AI or AI-led data projects.”

Phil Fersht, CEO of US-based HfS Research, said that the focus of most US businesses is going to be squarely on cost reduction, and this will have a direct impact on the global IT and BPO services industry. “IT services and advisory firms will need to act quickly to address these consumer impacts by getting into war room footing with companies to seek out where manufacturing and imports that are tariffed less can be moved.”

He said that IT firms must come up with strategies to help firms switch from innovation and growth models to responsible cost management and workforce realignment. “There will be no free trade zones. This won’t withstand the changing economics of this new world order, but it may allow savvy firms to help their customers shore up contracts and services needed to deliver goods as they lean out their operations,” he added.

Peter Bendor-Samuel, founder and chairman of IT advisory Everest Group, said the impact of tariffs on the US and global economy is significant and it is causing widespread uncertainty and a pull-back in investment. “This in turn is affecting discretionary IT spending which is affecting growth.”

He believes focusing on cost savings and investing in non-US markets seems to have more upside currently.

If you don't have an account, Register here |

With the exception of our Horizons reports, most of our research is available for free on our website. Sign up for a free account and start realizing the power of insights now.

Our premium subscription gives enterprise clients access to our complete library of proprietary research, direct access to our industry analysts, and other benefits.

Contact us at ask@hfsresearch.com for more information on premium access.

If you are looking for help getting in touch with someone from HFS, please click the chat button to the bottom right of your screen to start a conversation with a member of our team.