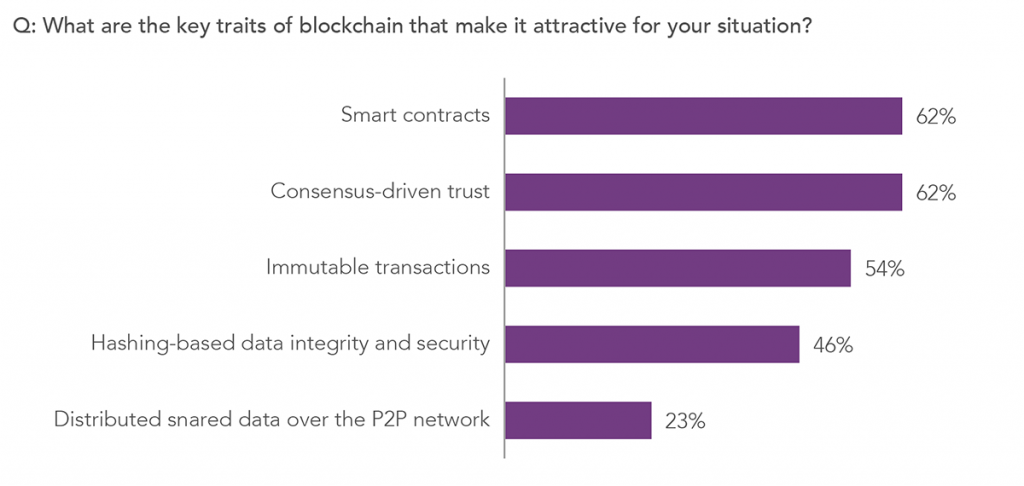

Since enterprise blockchain crashed on the scene, it has been heralded as the solution to embed trust within ecosystems, but its capacity to completely harness this potential remains relatively unexplored. In response, enterprises have moved blockchain down on their priority lists, with investment targeting new areas, particularly the much-hyped generative AI (GenAI). However, Exhibit 1 shows that consensus-driven trust remains one of the key reasons enterprises choose the technology.

One organization using blockchain for trust is the Small Industries Development Bank of India (SIDBI), the principal development finance institution for small and medium companies in India. SIDBI partnered with Infosys to develop a blockchain-fueled solution to deliver a new level of trust and transparency to its existing security interest exchange ecosystem, and the results have been encouraging.

We connected with leaders from Infosys and SIDBI to learn about their enterprise blockchain journey and hear from them directly why enterprises shouldn’t write off blockchain just yet.

Sample: Data from enterprise clients of the 15 service providers covered in HFS Horizons: Enterprise Blockchain Services, 2023

Source: HFS Research, 2023

SIDBI’s Institutional Finance Program is designed to increase access to credit for small and medium enterprises (SMEs), a market that often struggles to access capital as traditional lenders deem them high-risk investments. With the program, SIDBI provides refinancing opportunities for non-banking financial institutions, typically traditional lenders, which reduces SIDBI’s risk and allows it to extend credit lines to SMEs. In return, the lender pledges a security interest (a group of loans) to SIDBI as collateral to be liquidated in the event of a bad loan, mitigating risk for SIDBI.

It sounds like the perfect system. Traditional lenders face reduced risk, thanks to SIDBI refinancing loans, and SIDBI faces reduced risk due to the return of capital—but the reality is very different. The ecosystem is challenged with a lack of trust and transparency, which can have financial implications.

The incumbent process sees lenders share collateral loan details with SIDBI at agreed intervals, typically quarterly, semi-annually, or annually. This process relies on manual work from SIDBI and the lender to prepare, check, and verify each loan, and it also means there’s no instant access to information. For SIDBI, pledged loan conditions could change, increasing the risk of SIDBI’s refinancing portfolio without its awareness. In addition, lenders could pledge duplicate loans, offering the same loan to multiple institutional participants like SIDBI, all without SIDBI’s knowledge. That, in the words of SIDBI’s Chief Technology Officer, is why SIDBI turned to blockchain:

SIDBI’s chairman and managing director, Mr. Ramann, had the vision to leverage blockchain for exchanging information and building trust in the financial ecosystem. We realized lenders could give underlying securities that were duplicates, and there were cases of inconsistencies. It became a big challenge. That’s when SIDBI decided on blockchain so that we could bring all participants together, with the information on the underlying securities shared transparently.

– Paramendra Tiwary, Chief Technology Officer, SIDBI

In January 2022, SIDBI began ideating what this process might look like with blockchain. SIDBI didn’t have experience with blockchain but believed it could be a good solution for this challenge. Paramendra explained that Infosys was on SIDBI’s radar thanks to its work implementing blockchain for a government body, so SIDBI turned to the company for a solution. He explained that Infosys demonstrated technical and domain expertise, a solid ecosystem of partners, and an eagerness to deliver genuinely innovative outcome-driven solutions. Paramendra told us Infosys’ catalog of case studies and success stories instilled confidence.

The outcome wasn’t a reimagined process. Instead, a multi-party workflow was built on a blockchain to complement the existing process. The solution presents loans on the blockchain as NFTs, establishing clear proof of ownership before ultimately offering the loans to institutions like SIDBI as collateral for refinancing. This transparency prevents lenders from pledging duplicate loans. Paramendra explained:

We don’t intend to replace the existing system. Instead, we’re trying to create a security interest information exchange that ensures every part has visibility. The financial instruments already existed, but we’ve created levels of transparency that didn’t.

– Paramendra Tiwary, Chief Technology Officer, SIDBI

Eliminating duplicated loan pledging naturally reduces SIDBI’s risk exposure, but it’s far from the only benefit. For example, Paramendra explained that the historical process of exchanging security interest information relied on emails and Excel files, which had to be manually entered and verified at agreed intervals. Now, information is instantly verifiable when uploaded to the blockchain, eliminating manual effort, saving time and money, and allowing employees to focus on higher-value tasks.

The project completed a successful proof-of-concept and pilot phase with live stakeholders, and it is currently being socialized “far and wide” before an incremental rollout and expansion with more participants.

Adopting new technologies is never straightforward, but the years of hype and skepticism surrounding blockchain required executives to shift their mindset and look beyond the hype to the genuine value of the technology. Paramendra told us how SIDBI went through a long process of sharing use cases and success stories with stakeholders and educating them on the technology, how it works, and the value it can deliver. Now that it has completed a successful pilot, SIDBI advises that more cautious parties, including lenders, borrowers, and regulators, are interested. If your organization is considering a blockchain implementation, Paramendra has a simple piece of advice: Start small and have a roadmap for implementation.

Infosys also recognized that enterprises need to look beyond the hype to see the true value of blockchain, and when we asked Infosys leadership why organizations should pursue blockchain adoption, Dinesh Rao explained:

As the financial industry evolves, blockchain technology emerges as a foundational element in shaping tomorrow’s infrastructure. The SIDBI case exemplifies this major shift, reshaping organizational reliance and systemic risk management. Blockchains offer immediate benefits, including cost savings and reduced errors, while enhancing user experiences. Yet, the true transformative potential lies in creating trustworthy financial ecosystems through blockchain, poised to drive extensive change in the financial services landscape.

– Dinesh Rao, Executive Vice President, Co-Head of Delivery, Infosys

SIDBI believes this ecosystem could become the global gold standard for institutional lending and even beyond. Paramendra explained that in India alone, more than 100 lenders could leverage this platform. SIDBI’s roadmap includes expanding the ecosystem to include players like credit bureaus, a true ecosystem play. He explained:

The potential is mind-boggling. If we try quantifying this, the benefit could be huge. For now, our primary driver is assuring this is socialized far and wide to make sure we achieve scale and improve participation. We have large-scale ambitions.

– Paramendra Tiwary, Chief Technology Officer, SIDBI

To that end, Paramendra and his team are looking beyond perceived quick wins and instead focusing solely on the project’s long-term success. This meant that, from the very beginning, SIDBI worked hard to bring key ecosystem stakeholders on board early, socializing the solution far and wide. In addition, SIDBI and Infosys defined a clear roadmap, strategy, and vision for the ecosystem, including new functionality around monitoring, data visualization, and analytics. The outcome is that SIDBI has spurred significant interest in the solution, which it hopes will ultimately result in significant industry participation.

SIDBI and Infosys have developed a blockchain-fueled solution that serves as the trust layer across an entire financial ecosystem without completely redesigning the process. The success of the proof of concept should give enterprises the confidence to look beyond the blockchain naysayers and recognize that the technology can deliver genuine business value for their organization and ecosystem.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started