The trade finance marketplace should transform analog and siloed ways of working, replacing manual checks and balances with the trust, transparency, and traceability of distributed ledger technology (DLT) such as blockchain. Infosys is leading the way with a digital trade platform already connecting 17 banks.

The trade finance marketplace covers financial services and instruments (documents) that facilitate the global movement of goods and services. Infosys is unifying banks—key facilitators of the trade through bank-intermediated finance—by harnessing blockchain technology to digitally connect and facilitate interoperation efficiencies, reducing the cost base, and opening new revenue opportunities, such as newer models of credit and funding backing the trade.

Blockchain can amp up efficiency by helping to integrate processes. Take the case of a consortium of banks whose trade finance processes were re-engineered by Infosys through blockchain. Previously these banks ran their trade finance operations and interactions in silos. Most documentation that came through the door was managed manually, contracts were checked manually, and bills of lading were financed multiple times due to the inability of banks to verify their authenticity, with the risk of multiple versions of the truth.

Infosys is attempting to bring transformation through blockchain; what started out as a pilot with seven banks in 2018 is now a fully-fledged operation that includes 17 banks. The aim is to build a future digital trade finance platform connecting the entire ecosystem of all core participants—issuing banks, participant banks of the Indian Banks’ Blockchain Infrastructure Consortium (IBBC), buyers and suppliers, and their logistic providers. The ecosystem connecting the core participants is powered by Finacle Trade Connect—an open stack architecture on the cloud, which is API agnostic, smart contract-ready, private, and permissioned. The result has been cost-effective and frictionless interoperability of transaction data, a 75% reduction in cycle time, and immutable and transparent records of critical trade transactions with real-time visibility shared securely across network banks. Almost by definition, where participants, in this case, banks are not known, blockchain technology can add trust, transparency, and traceability as seen in Exhibit 1.

Source: HFS Research, 2023

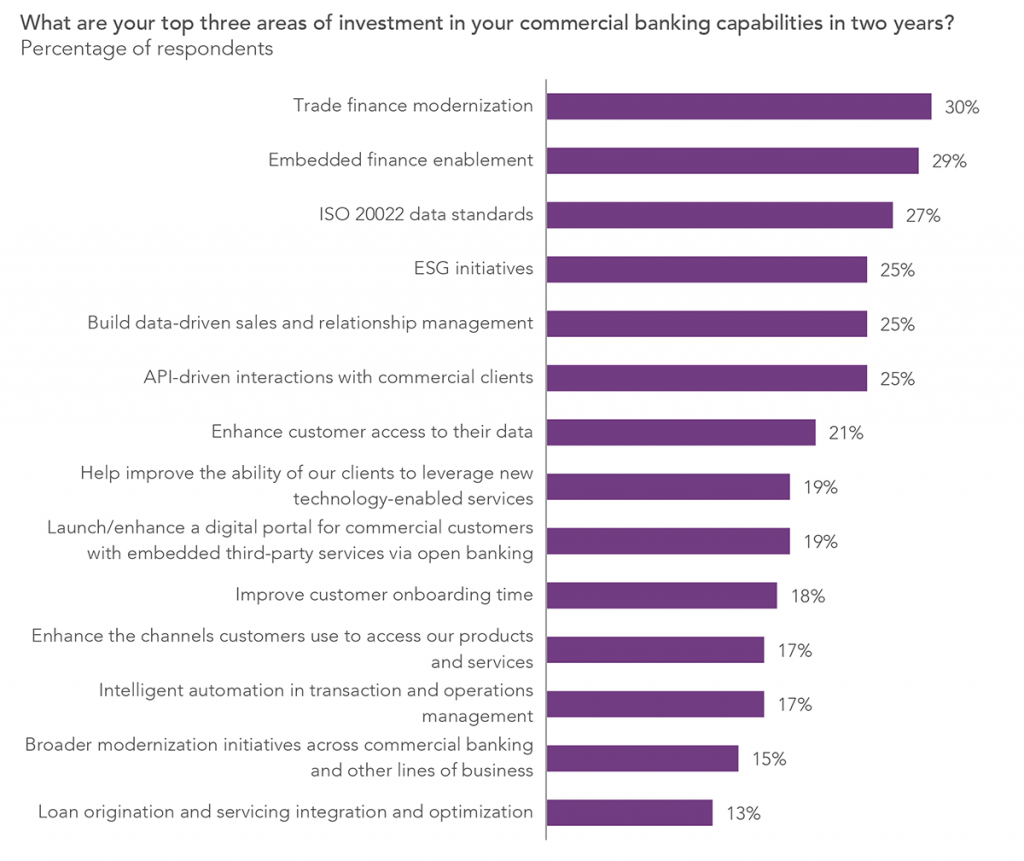

Commercial banks are ready for and prioritizing trade finance modernization over the next two years as shown in our data in Exhibit 2.

Sample: 150 commercial banking leaders

Source: HFS Research, 2023

We are seeing global trade finance banks, such as Bank of America and HSBC, announcing similar projects leveraging blockchain-enabled technologies. To ensure global trade finance experiences the full range of benefits from blockchain, they must include more actors across the global trade supply chain, interoperability, and standardization. The network interface should allow transactions to flow, whether on, or off the blockchain. Governance and regulatory bodies must harmonize the data standard, much like ISO 20022.

Trade finance is a good match for technology such as blockchain—a technology that is a custodian of trust with no intermediaries while promoting decentralization—and the trade finance marketplace is ready to modernize. Infosys has proven the commercial applicability of the technology through its use case for a consortium of banks. However, a good portion of what Infosys has developed for the banks is within a sandbox in which all parties interact by the rules they’ve established. Blockchain networks now need to accommodate regulatory and cross-border challenges. The upside for enterprises is reduced costs and lower complexity, so leaders should look for trade finance partners who are keeping pace with the blockchain revolution.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started