A year ago, HFS was deep in developing our first report on metaverse services. Eighteen leading service providers queued up to engage. Enterprises were ready to invest (half had committed to 10% to 20% growth in metaverse budgets). An estimated $1 trillion metaverse economy was nigh. So, what has happened since? We returned to the same group of service providers for an update. We found the metaverse is still in the starting blocks, its path somewhat impeded by the crypto crash and the elephant in every room that generative AI (GenAI) has become.

It is worth noting that less than half of those who engaged a year ago responded to our request for a quick update a year on, perhaps telling its own story of a fall in both focus and interest. The eight that did respond represent a cross-section of tier 1 and 2 service providers.

A year ago, metaverse budgets were still at the test-and-learn stage—rounding errors in most firms’ technology budgets. Of our sample, only 25% have seen revenue growth since (see Exhibit 1). There is some growth in headcount, but the overwhelming message is of a standstill (see Exhibit 2) rather than the meteoric growth last year’s hype suggested we should expect.

Sample: Q3 2023, n= 8 global service providers

Source: HFS Research, 2023

Sample: Q3 2023, n= 8 global service providers

Source: HFS Research, 2023

Exhibit 3 tells the story of client demand. Here, we see a small drop in the extent to which clients are seeking “metaverse services” rather than the specific products or services that may have previously fallen under the metaverse umbrella, such as augmented, virtual, or extended reality (AR/VR/XR), digital experiences, or digital twins. A year ago, 25% of our respondents said clients were more likely to ask for metaverse first. Now, 3 of 8 say that happens less than 25% of the time.

Demand for metaverse services has not fallen off a cliff, but metaverse is less likely to be a term used in client conversations than a year ago.

Sample: Q3 2023, n= 8 global service providers

Source: HFS Research, 2023

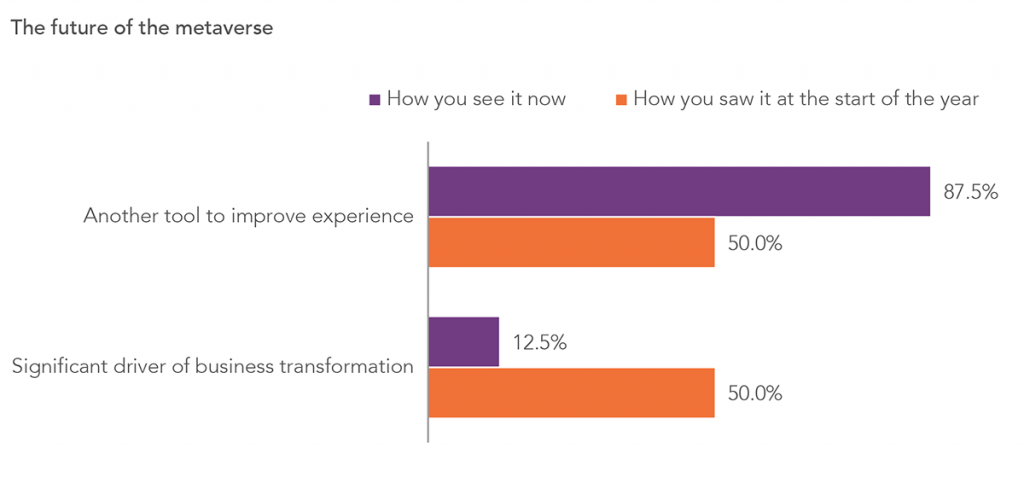

Clients appear to be looking at the constituent technologies of metaverse services less strategically than a year ago. The focus is now on use cases for digital twins or digital experiences rather than trying to shape their organizations’ future through the metaverse lens. That shift to see the metaverse as a tool rather than a driver of business transformation is supported by responses from our cohort of service providers in Exhibit 4. Seven out of eight of them see it as “Another tool to improve experience.”

A year ago, half saw the metaverse as a significant driver of business transformation. It’s worth noting that we offered respondents the option to say the metaverse was “On pause for now” or “A busted flush.” None chose either option.

Sample: Q3 2023, n= 8 global service providers

Source: HFS Research, 2023

The story emerging is one of pragmatism in a sector that has had to fight for crumbs in challenging times, quietly getting on with honing its capabilities for client needs. We offered service providers anonymity so they could comment freely on what they were experiencing.

The crypto meltdown didn’t help. One leader told us, “In 2022, we believed that tokenomics would fuel the metaverse explosion. However, the lack of interoperability and the general crypto disaster put paid to that theory. On the plus side, customers are still seeking immersive experiences, and that’s where we see exciting things coming—the evolution of storytelling.”

Another agreed, “The talk around transactional commerce elements (cryptos and NFTs) has decreased a bit, but the space around the industrial metaverse and digital twins has renewed interest. We have added capabilities in this space.”

Metaverse technology continues to evolve. Headsets are less the flavor of the season, but augmented reality remains on-trend. One service provider told us, “We’re witnessing an evolution in technology available for clients, including packaged metaverse solutions with improved smartphone support and better cloud provider coverage for immersive 3D experiences (such as optimized GPU servers) as the backbone of metaverse services. Increased awareness and curiosity for metaverse concepts from clients and their customers continue to drive new business opportunities.”

Another said, “We’ve seen a significant shift from reliance on technology such as headsets to more inclusive options and technologies such as browser-based solutions, which makes the metaverse more accessible and doesn’t require investment on behalf of the customer, client, or consumer.”

The shift toward more practical and impactful use cases reported by service providers is as HFS predicted in our report at the turn of the year. Some see a growing demand for interactive social experiences in digital realms and for help managing the constantly increasing volume of user-generated content.

We are also hearing of metaverse offerings combined with user behavior analytics in virtual environments for user insight.

And another service provider told us, “We are starting multiple POCs [proofs of concept] regarding the use of metaverse in the context of onboarding and training employees (immersive employee experience).” While the drive back to the office is real, there is continued recognition of the need for initial onboarding and ongoing education for teams working hybrid lives.

It seems the GenAI beast may yet be a beauty for metaverse proponents. Many service providers believe GenAI and metaverse will complement each other, improving customer and employee experiences and augmenting capabilities. “Our integration of GenAI capabilities into metaverse solutions is fostering a new wave of innovation,” as one service provider put it.

While the hype around GenAI has proved a near-term blocker for the metaverse journey, mid-term GenAI could become the accelerant to fuel the flames of the next metaverse revolution. GenAI can reduce the cost of building metaverse solutions (through software engineering efficiencies) and open the way to genuinely personalized experiences through its content and image generation powers. GenAI is more friend than foe for the metaverse.

The last year has been tough on the metaverse. It fell out of vogue. Cryptocurrency horror stories flooded the web, and a new shiny object appeared in the form of GenAI—just when the metaverse needed it least. Enterprise leaders may have paused their plans to scale, but they would be wise to revisit their strategies with the clear eyes of this post-hype moment. There is value to be generated from the metaverse, and in combination with GenAI, a whole new wave of value innovation awaits.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started